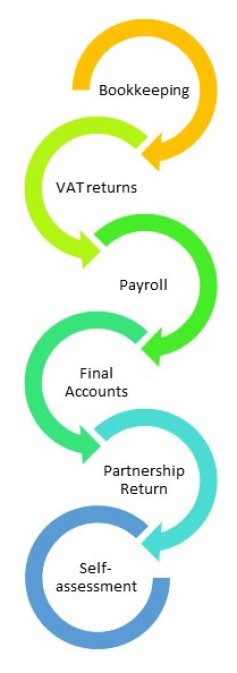

Basic Partnerships

Being very similar to sole trader business, partnerships are treated in much the same way with the addition of the partnership return.

I can offer varying levels of support and service, adapted to your needs, either on-site or remotely with regular communication.

- Cloud based software

- Sales & Purchase ledger reporting

- Integrated bank feeds for up-to-date info

- Bank reconciliation

- Automated receipt capture

- Making Tax Digital for VAT compliant software

- Spreadsheet integration for VAT

- Submission to HMRC

- RTi compliant software

- All frequencies of payroll supported

- Holiday calendar

- Paperless system & Secure reporting

- Auto-enrolment

- Submissions to HMRC and pension providers

- Professional and accurate unaudited accounts

- Simple Income & Expenditure statements

- Preparation of partnership return

- Submissions to HMRC

- Breakdown of partnership liability

- Preparation of self-assessment

- Submission to HMRC

- Calculations of tax liability